REINVENTING MADDENS

Recounting Efforts To Reanimate A Beloved Downtown Hardware Store

The Mount Holly Reporter Nick Sodano October 13, 2024

SUMMARY: Downtown merchants faced hardships in the 1970s as new national economic forces took hold. With customers shifting dollars to suburban merchants, downtown business districts experienced blight causing New Jersey to launch its “Urban Enterprise Zone” [UEZ] program in 1983. But the scope and scale of the program’s revitalization efforts has been a matter of sharp debate. This article explores these issues, and considers a UEZ loan that failed at the beloved hardware store Maddens, causing the loss of public money and leaving the township with ownership of a gutted property. As 2024 draws to a close, a renewed UEZ program considers questions about conflicts of interest and a new property owner steps forward to reinvent Maddens.

For decades, Maddens Hardware on Mill Street was an important part of the downtown commercial landscape. During the early 1990s I visited Maddens to get screen windows fixed and buy anything from spray paint to coffee percolators. But even better, the Madden’s clerk provided “small town service”. She radiated an irritability that inspired me to say “Good MORNING, Sunshine!” when I entered the store. Which was guaranteed to elicit a vigorous reply of “Oh, WHAT do you want NOW?!”. Better yet, after my purchase she would deposit change in my hand and flatly intone, “You may leave”. You simply won’t get that kind of entertainment at Home Depot.

And I miss it because the 21rst century accelerated a trend of small business departures from our downtowns. One by one the unique personalities of small clothiers, grocers, butchers and bakers disappeared, leaving a wake of vacancies in the business district.

By 2011, Maddens sat closed on Mill St, its windows decorated by volunteers [See upcoming Main Street article] in an effort to soften the mute testimony of an abandoned downtown. And for Mount Holly township officials, the blighted, empty shops in our downtown were a vexing reminder of the dominance of online shopping and big box stores. This situation posed an existential question: How do we revitalize the business district?

What Happened?

Before we explore how Mount Holly tried [and is still trying] to fully revitalize its downtown, lets briefly examine how our town found itself in so much trouble. In his book “What Killed Downtown”, Michael E. Tolle discussed the transportation revolution that gave America a post war explosion of private cars.

Larry Tigar, the former President of the Mount Holly Historical Society stated that “Friday was the big night when people from the farming areas would come to town for groceries at the Acme or the A&P”. Acme was located at 47 Mill Street [now the cannabis dispensary “Voltaire”].

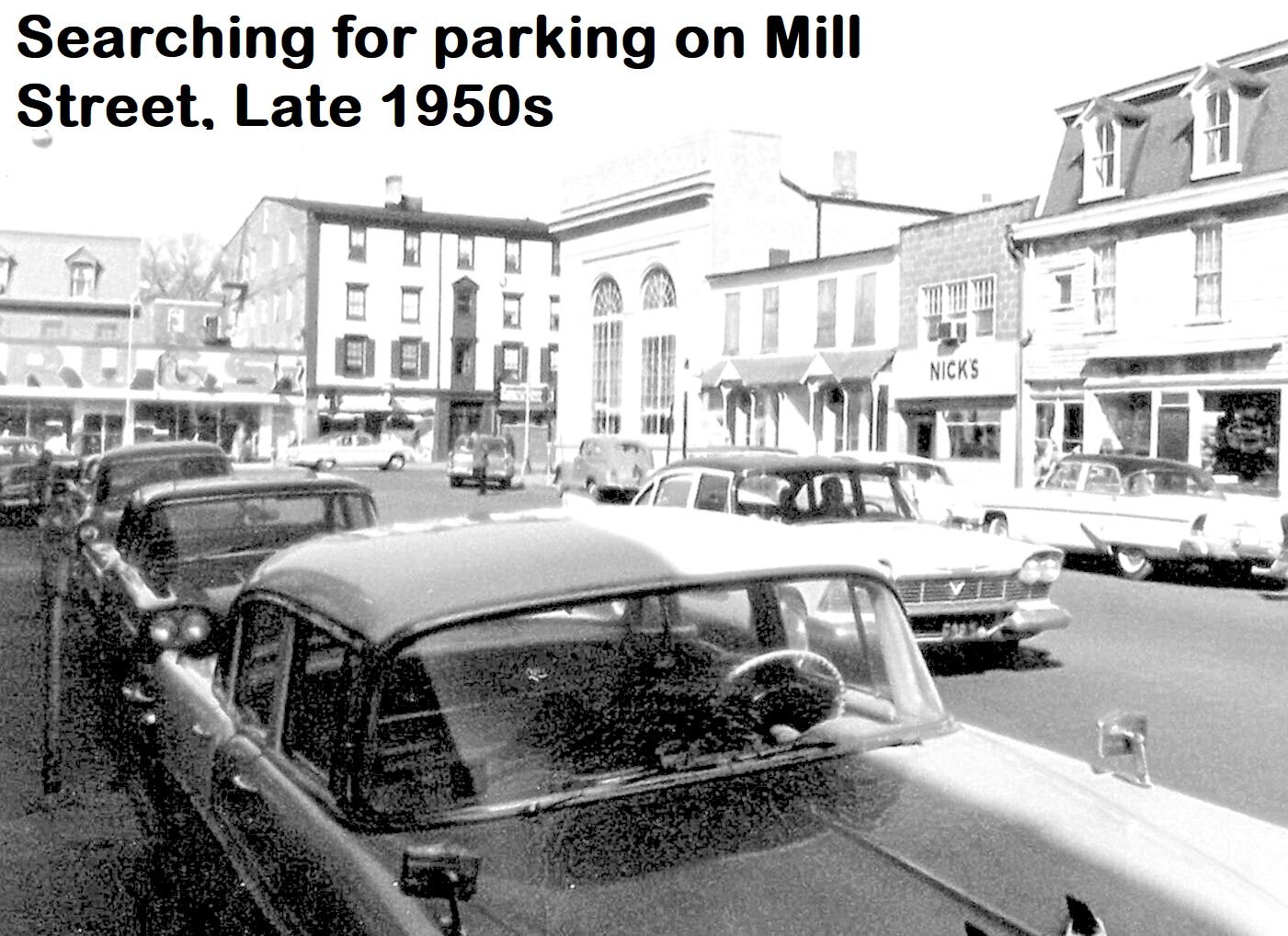

Towns all across the country were experiencing a similar flood of vehicles that caused traffic congestion in downtown business districts. Mount Holly was no exception. Frustration set in as people searched in vain for limited duration parking where meters registered “Violation” if cars overstayed the allotted time. Police officers issued summonses for violations, ruining the day of shoppers who lost track of the time. The Mount Holly’s Acme was blessed with 80 parking spots on Paxon Street, but other shops were not so lucky. So the Township decided to sacrifice downtown recreational fields for more parking during 1956. It was a valiant attempt to accommodate consumers, but the die had already been cast in favor of the new economic paradigm.

The postwar paradigm included a highly mobile consumer and a commercial sector eager to expand into new, bigger buildings. Buildings that our 19th century downtown did not offer. But the wide-open suburban landscape welcomed such construction and so large structures surrounded by a sea of free parking were built in green space outside of the downtowns.

Try as they might, small towns like Mount Holly couldn’t reverse these powerful economic forces of affordable automobiles and supersized suburban commercial competition. The economic shift coincided with a baby boom and its corresponding housing boom that ballooned the population of former farming communities like Mount Laurel by 800% while Mount Holly’s population shrank from just over 13,000 residents in 1960 to its current rebound population of more than 9,000.

This nationwide trend of new retail and service store construction outside the urban centers on major suburban roads was reflected in Mount Holly’s “Fairground Plaza”. Larry Tigar states that grocer Acme and department store W. T. Grant moved into the new larger buildings of the Fairgrounds Plaza in 1959, leaving the old downtown spaces behind.

As the federal government built the interstate highway system, housing developers created new subdivisions on former farmland. The new homeowners chose to frequent the nearby suburban stores with their big selections, abundant free parking with less traffic and tidy appearance. Mount Holly swam against this current by building a “bypass” sometime before 1972 to alleviate traffic, but consumers had already shifted their preference.

The next assault to downtown business came in the form of a real estate innovation called “malls” that began in 1962 in Mooretown and Cherry Hill and then in Voorhees during 1970. These were essentially shiny new indoor downtowns with air conditioning, landscaped atriums, food courts, two stories of shopping variety and “anchor” stores like Macys to top it off. By 1982, the Burlington Center Mall was built, bringing the mall phenomenon to Mount Holly’s doorstep. The future looked grim

1983 - Enter the Urban Enterprise Zone.

None of this was lost on the State Legislature which decided in 1983 that it would address blighted downtowns by creating something called Urban Enterprise Zones [UEZ]. The statutory intent for a UEZ was to mitigate areas of “high unemployment, low capital investment, blighted conditions, obsolete or abandoned industrial or commercial structures, and deteriorating tax bases”. By the 1990s our downtown was indeed characterized by blighted, vacant store fronts that further discouraged visits to the remaining businesses. Adding insult to this injury, persistent comments from residents warned of crime. And despite the removal of parking meters and the addition of large parking lots within a block of downtown shops, residents also complained of inadequate parking.

And so town leadership seized upon the UEZ concept combined with a volunteer program [see upcoming Main Street article] as a way to turn the trend around. Mount Holly applied for and became a State UEZ community in 1995.

The designation allows participating businesses to attract customers away from the big boxes with a 50% state sales tax cut. Participating businesses also enjoy tax-free purchases on capital equipment for expansion or other property upgrades, and a one time $1,500 tax credit for hiring employees who live in the UEZ town. The designation also gives UEZ governments a Zone Assistance Fund (ZAF) allocation which is money provided by the State for economic development activities via grants, loans and public programs. The grants and loans fund private property upgrades or business expansions and startups. The public projects include infrastructure upgrades like signage, lights, improved public websites, cleaning of streets, and improved public safety with new police patrols. To oversee the entire effort is funding for a full time UEZ “coordinator”. The Coordinator’s job is to recruit businesses to participate in UEZ program, to assure its grants and loans are administered correctly, and to measure program success, especially with regard to the creation of new jobs and businesses.

POLITICAL TURMOIL ABOUT THE UEZ PROGRAM

The State of New Jersey reasonably expected that in return for all the money invested in its 37 UEZ communities, it would receive measurable increases in private sector jobs and commerce. This did occur but disagreement arose about HOW MUCH increase was needed to consider the program a success.

The point of view expressed by Governor Chris Christie ignored positive outcomes like reversal of blight and modest increases of capital investment and new jobs. Christie’s definition of success was a massive business boom that eclipsed all state revenue losses from UEZ tax cuts. Since UEZ communities didn’t produce those outcomes, Christie called the UEZ program an "abject failure" with a "devastating impact" on state revenue.

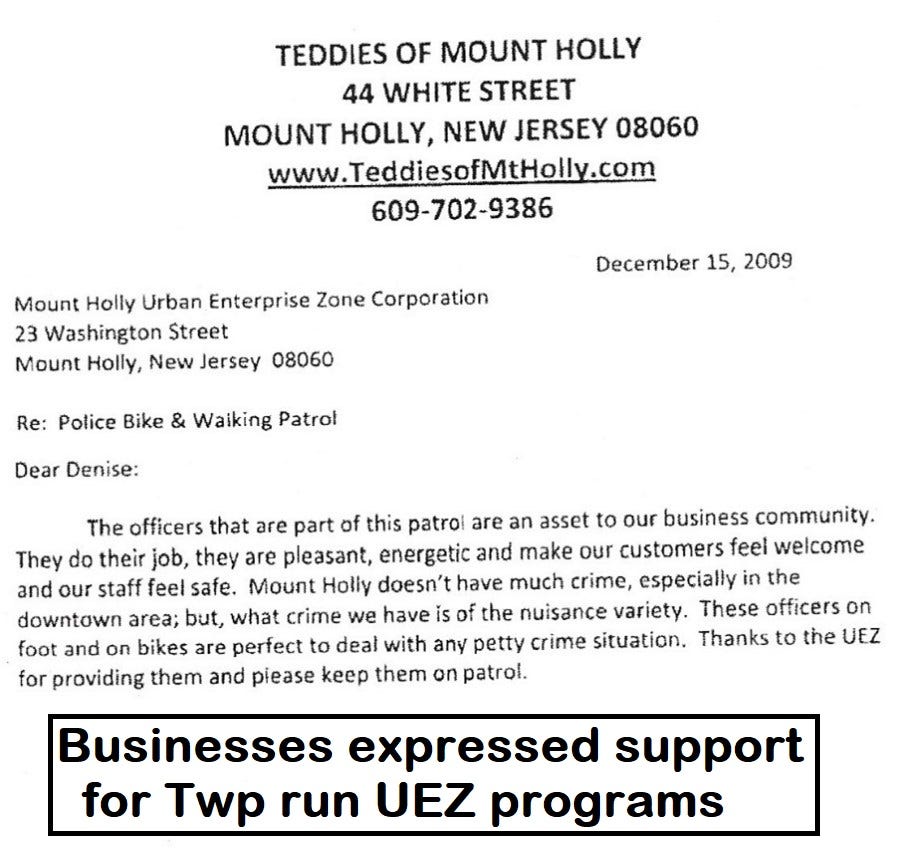

In a 2011 application for UEZ funding, Mount Holly adopted the State’s framing of UEZ goals complete with predictions of new businesses and jobs. The application for a $97,765 UEZ grant stated that not only would the grant deliver six police officers for “Downtown Walking and Bicycle Patrols” but would only be deemed successful if “the annual crime index for the township is reduced by 5% to 8 %” AND if police patrols and “other initiatives” created “5 new businesses with 5 – 10 new jobs”.

This application coincided with Chris Christie’s Fiscal Year 2011 budget plan that featured a Department of Economic Development UEZ program assessment that said the UEZ’s overall return on State investment was negative. Christie terminated the zone assistance fund which eliminated funding to the UEZ towns beginning July 1, 2011.

Not surprisingly, local political leaders didn’t agree. In 2016, Elizabeth Mayor Chris Bollwage said “Christie is systemically eliminating an economic development tool for the urban communities of New Jersey”. And During 2018, Governor Phil Murphy sided with local officials when he stated that the zones are an important economic driver in troubled business districts. By 2019, Murphy commissioned a new assessment of the UEZ program which concluded that between 2013 and 2018, businesses which participated in the UEZ Program experienced faster output, earnings, and employment growth than businesses that did not participate in the program. The new assessment acknowledged that UEZs are not a silver bullet to eliminate all economic challenges faced by urban business districts, but are an important tool for urban revitalization that should not be cast aside. Consequently, Murphy reversed Christie’s decision regarding the Zone Assistance Funds. And so ZAF were reinstated in 2022 with a qualification that the State should strengthen data collection with intention to tailor the program toward improvements, such as ending UEZ status for any business which has been on the program for 10 years.

During 2022 and 2023, the State UEZ allocated $852,213 to Mount Holly’s Zone Assistance Fund. This money is held by the State until Mount Holly finishes it 5 year UEZ plan, which was developed during July of 2024 with resident input. See https://twp.mountholly.nj.us/departments/economic-development-uez/

UEZ 2011: MUNICIPALITIES ON THEIR OWN…

After Chris Christie cut funding to every Enterprise Zone in 2011, Mount Holly found itself without new state money going forward, but also without even a little state oversight of the money that was previously supplied. Summing up news from zones throughout New Jersey, UEZ Board Member Audrey Winzinger said other UEZs were “keeping their Directors & offices firmly in place” despite the end of state level funding. The September 2011 UEZ Board Meeting Minutes said “The UEZ will work … at the Municipal level not the State level. We no longer have to submit projects to the State, which will significantly lower the turn around time for projects and loans.” But this new ease of decision making came with risks.

THE UEZ WINNING STREAK

By the end of 2011, Mount Holly’s UEZ had invested $2,900,516 in dozens of successful loans to local businesses. Former Council Member Joe Jones ran the masonry supply business known as G.W. Lippencott’s on Washington Street [now Athenia Supply]. He received and paid off a $30,000 loan to expand his business into a new line of masonry supplies. Mr. Jones said that without the loan, he would not have been able to make that expansion.

There were of course other loans that did not end well. The Mount Holly Reporter obtained records which indicate that by 2011, about 4 loans had defaulted with losses of at least $13,000, giving the UEZ a loan default rate of about 10%. If you compare that rate with Federal Reserve statistics, you see a somewhat lower national default percentages in commercial loans during this timeframe [which notably included the 2009 Great Recession]. But considering that the UEZ’s mission is to prioritize economic development over profit and to operate within a severely restricted geographic pool of applicants [only Mount Holly], the slightly higher overall default rate is not surprising. Simply stated, commercial banks do not share the same motivations and limitations as a UEZ Program since the UEZ loan program was designed to take on greater risk in pursuit of a common good for the business district.

But in general, UEZ loans were repaid with interest and so deposits into what was known as a “Second Generation” fund grew. The town used those second generation funds like a revolving credit account to invest in new economic redevelopment projects for zone businesses.

Audrey Winzinger recalled that during 2010, the zone had “$1.3 million in our 2nd generation account” and an “estimate of $156,000” in the administrative account for government projects like police patrols and “Operation Clean Sweep” for street cleanup.

So, while Governor Christie’s termination of the ZAF meant that new money would no longer enter the “First Generation” account, with good management of second generation money the township could continue its “Good Neighbor” loan program indefinitely. It was in this newly restrictive fiscal environment that Mount Holly considered a loan to redevelop the Madden’s Hardware site. It was up to Community Development Director Josh Brown, the UEZ Board and Town Council to manage the money.

THE MADDEN’S LOAN

The UEZ reviewed a September 26, 2011 loan application from an active Mount Holly police officer. The officer’s construction company sought $250,000 for the “purchase of 20-22 Mill St/19 Church St. also known as Maddens Hardware. Will be purchased ‘As Is’ and requires extensive renovations”. The application stated that the “property will be renovated with 2 upscale residential apartments and a commercial/retail space”.

UEZ Meeting Minutes for September 2011 say that a loan was approved by the UEZ Board, but revised to $150,000 loan at 4% interest, with payments of $1,320 per month. The minutes state a print shop, property management business and 2 offices or businesses will be housed on the first floor with apartments on the second and third floors”. Regarding construction, the minutes stated that “it will take 6 – 9 months for the façade portion to be completed. More information is needed to complete the renovation portion of the loan”.

The officer’s company purchased Madden’s for $150,000 on October 4, 2011 and Mt. Holly Twp issued permits to that police officer’s company for interior demolition and removal of petroleum storage tanks on October 19, 2011. Open Public Records Act documents reveal that no additional construction permits were issued for the promised renovation tasks and that the township did not have records of conducting “any violation or inspection report” from the Construction office for the Madden’s property. It was through such documents that the Reporter hoped to determine whether Mount Holly Township was doing oversight for the loan project.

TOWNSHIP OVERSIGHT OF PROJECT: “I DO NOT HAVE TIME FOR THIS”

By December 2011, emails of alarm were being sent to Community Development Director Josh Brown about the danger of the “Good Neighbor” loan defaulting on its promised renovation. But those warnings were dismissed.

Unfortunately, the resident warning of project failure was not wrong. By August 2013, the property sat gutted and on the market seeking a new investor. By July 30, 2014 an email from the resident stated that the officer had “lowered his price yet again” and that the loan was often in arrears because despite having a monthly payment due, the officer paid quarterly. Additionally, “the borrower has

been formally asked to bring the account current before year end. expect he will comply as in the past. Taxes in arrears for 2013: $8k+”.

And so on 1/31/2016, with no investor willing to meet his price and no funds to complete the work, the police officer deeded Maddens to Mt. Holly for a dollar, leaving a large portion of the loan unpaid.

LOSS ESTIMATES

Assuming the loan performed until the end of 2015, the Twp would have been able to collect just over $67K of the $150,000 loan, leaving $82K uncollected. The Township then held the vacant property for nearly eight years, forfeiting as much as $64K of tax revenue. When the Township sold the property for $1 on October 5, 2023, it provided the buyer with a tax abatement that gave a 90% discount on the taxes for five years, which means that as much as $36K is forfeited.

Questions emailed by The Reporter to Township Manager Josh Brown regarding actual losses incurred, Township’s oversight of the loan, its options to recoup loan money as well and information about Brown’s salary as a UEZ Administrator have gone unanswered as of the publishing date of this article.

2024 – UEZ CONSIDERS LOANS GOING FORWARD

At the September 4, 2024 meeting of the Mount Holly UEZ, the Reporter asked the Board about conflicts of interest with loan applicants. The Reporter asked the Board to discuss its rules, policies and or thinking about conflicts of interest in loans. Specifically, whether the UEZ would make loans to employees of Mount Holly Township and or UEZ Board members.

Board member Lauri Shepard said that for a number of years since she has been on the Board, it has been Board policy that loans would not be made to township employees.

Board member Vince Amico said that while he was not aware of the historic rules on the matter, his UEZ loan enabled him to get started with his ice cream business and that the loan was paid back. He said he was aware that Board members have had long term relationships with business owners and loans to those owners were paid back.

Audrey Winzinger stated that there are “only so many of us that have businesses in town” and so personal relationships between Board members and business owners is unavoidable. “The main concern is that we have good underwriting”. Ms. Winzinger stated that the number of bad loans can be counted on one hand and that is because of the due diligence in the underwriting process.”

The Reporter does not have written confirmation that the Mount Holly UEZ Board has produced written rules or policies regarding conflicts of interest. Answers provided to The Reporter indicate that the UEZ Board may have a verbal policy forbidding loans to active Mount Holly employees. There is agreement with current and former Board members that loans to Board members or to businesses with personal ties to Board members is acceptable as long at underwriting indicates the business can pay back the loan.

STATE UEZ: CONFLICTS OF INTERESTS IN LOANS AND OTHER USES OF UEZ FUNDS

An interview with a State UEZ official was conducted by The Reporter. The program maintains that Board Members should be eligible to receive business loans if their business is within the zone, but they should recuse themselves from voting on their own loan. The decision about ethics restrictions on these things is the domain of Township and or State Ethics rules, not imposed by the State UEZ. Regarding the use of second generation funds, the state UEZ does not maintain oversight of those uses, but should they receive a complaint from the public that the funds are not being used correctly, they maintain authority and may investigate. When Governor Christie released the last UEZ funds to townships in 2011, it was to be used for UEZ projects and within UEZ designated areas. Uses such as fire works and entertainment are considered valid uses if they bring customers into the UEZ area. An invalid use would be something like the purchase of school buses. The money is for the benefit of the UEZ, not a bonus for the general budget of the town. This includes second generation funds.

EXAMPLE OF LOANS MADE IN RECENT YEARS

MADDEN’S REINVENTED

And so it came to pass that the imaginatively named entity called “Accumulating Equity Partners Urban Renewal LLC” [Equity Partners] finally ended the Township’s chapter as owner of the former Madden’s property.

On 11/14/23, Albert Feiola of Equity Partners told the Reporter that their goal is to renovate it for “commercial on bottom and residential on top” using strictly private capital. By 8/16/24 Feiola had acquired a Mount Holly building permit to complete structural work “as per engineer plan” approved by the township. Mr. Feiola told the Reporter that construction would start in September and he is “hoping to have … grand opening for the apple cidery in April”.